The digital asset landscape is continuously evolving, presenting new opportunities for investors and enthusiasts alike. Within this dynamic environment, platforms and communities focused on identifying significant growth opportunities have gained considerable traction. The concept of seeking substantial returns is a driving force for many participants in the crypto space. This pursuit often leads individuals to explore various resources and communities dedicated to uncovering assets with exponential potential. The journey involves understanding market trends, technological innovations, and the broader economic factors that influence digital asset valuations. Understanding Crypto 30x

Navigating this complex ecosystem requires more than just luck; it demands insight, research, and a structured approach to investment. Many seek guidance from established platforms that provide analysis and community support. The goal is to make informed decisions in a market known for its high volatility and transformative potential. Engaging with a dedicated community can offer valuable perspectives and shared knowledge, which is crucial for anyone looking to understand the nuances of high-growth investing in the digital age. Understanding Crypto 30x

Understanding the Core Concept Behind High-Growth Crypto Assets

High-growth crypto assets typically represent projects that offer innovative solutions or disrupt existing industries. These projects often start with a relatively low market valuation, providing room for significant appreciation as they gain adoption and recognition. The underlying technology, such as blockchain, enables new forms of decentralized applications and financial systems. Investors are drawn to these assets because of their potential to generate returns that far exceed those of traditional investments.

However, identifying these opportunities early is a challenging endeavor. It requires a deep dive into the project’s whitepaper, the credibility of its development team, and the utility of its token. The community surrounding a project also plays a vital role in its long-term success. A strong, engaged community can drive adoption, provide feedback, and contribute to the ecosystem’s growth. Therefore, the core concept revolves around finding fundamentally sound projects before they become mainstream.

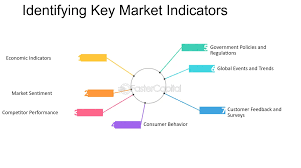

A graphical representation of market analysis, crucial for identifying trends.

The appeal of these assets is not just financial; it is also ideological for many participants. The crypto movement is built on principles of decentralization, financial sovereignty, and open access. Supporting projects that align with these values adds another layer of motivation for investors. They are not just betting on a price increase; they are participating in a technological and social revolution. This dual incentive makes the search for high-growth crypto assets a unique and compelling journey.

The Essential Role of Fundamental Analysis in Crypto Investing

Fundamental analysis is the cornerstone of any sound investment strategy, especially in the crypto world. It involves evaluating a project’s intrinsic value by examining various qualitative and quantitative factors. Key aspects include the problem the project aims to solve, the technology it employs, and the competitiveness of its solution. A thorough analysis helps investors distinguish between genuinely innovative projects and those that are merely hype-driven. Understanding Crypto 30x

Another critical component is the team behind the project. Experienced developers, advisors with industry expertise, and a transparent operational history are positive indicators. The project’s roadmap and its progress against stated milestones provide insight into its execution capabilities. Furthermore, analyzing the tokenomics—how the token is distributed, its utility, and its inflation rate—is essential for understanding its long-term value proposition. Understanding Crypto 30x

“The goal of the successful investor is to have the facts on their side and the patience to wait for the market to recognize those facts.” – This principle is paramount in crypto investing.

Engaging with a community focused on fundamental analysis, like those often discussed in relation to crypto thirty ex com, can be incredibly beneficial. These communities pool resources, share research, and debate the merits of various projects. This collective intelligence can help individual investors avoid common pitfalls and identify promising opportunities they might have missed on their own. It transforms investing from a solitary activity into a collaborative effort. Understanding Crypto 30x

Navigating Market Volatility and Managing Investment Risk

The cryptocurrency market is renowned for its high volatility, where prices can swing dramatically in short periods. While this volatility presents opportunities for substantial gains, it also introduces significant risk. Effective risk management is, therefore, non-negotiable for any serious investor. The first rule is never to invest more than one can afford to lose. This simple principle protects investors from catastrophic financial losses. Understanding Crypto 30x

Diversification is another key strategy. Instead of concentrating funds on a single asset, spreading investments across multiple projects can mitigate risk. This approach ensures that the underperformance of one asset does not drastically impact the overall portfolio. Additionally, employing a long-term perspective, often referred to as “HODLing,” can help investors weather short-term market fluctuations and benefit from long-term trends. Understanding Crypto 30x

A balanced scale symbolizing the importance of risk and reward management.

Setting clear entry and exit points before investing is a disciplined way to manage emotions. Using stop-loss orders can automatically sell an asset if its price falls below a predetermined level, limiting potential losses. Conversely, taking profits at specific targets can lock in gains and prevent greed from undermining investment success. Emotional decision-making is often the downfall of investors; having a predefined plan helps maintain objectivity. Understanding Crypto 30x

The Impact of Global Economic Trends on Digital Assets

Digital assets do not exist in a vacuum; they are increasingly influenced by global macroeconomic trends. Factors such as inflation rates, interest rate policies set by central banks, and geopolitical instability can all impact investor sentiment towards cryptocurrencies. For instance, in environments with high inflation, investors may flock to Bitcoin and other crypto assets as a store of value, similar to gold.

Technological adoption cycles also play a crucial role. As blockchain technology becomes more integrated into traditional finance and various industries, the utility and value of associated tokens can increase. Regulatory developments are another major factor. Positive regulatory clarity in a large market can lead to bullish sentiment, while restrictive regulations can create uncertainty and downward pressure on prices.

| Macroeconomic Factor | Potential Impact on Crypto Markets |

|---|---|

| High Inflation | Increased interest in crypto as a hedge against currency devaluation. |

| Low Interest Rates | More attractive environment for risk-on assets like cryptocurrencies. |

| Regulatory Clarity | Can lead to increased institutional investment and mainstream adoption. |

| Geopolitical Tension | May drive demand for decentralized, borderless assets. |

Understanding these interconnections allows investors to anticipate market movements better. It adds a layer of macroeconomic analysis to the fundamental and technical research they are already conducting. An informed investor is aware that a tweet from a prominent figure might cause a short-term spike, but long-term value is built on broader economic and technological foundations.

Building a Sustainable Mindset for Long-Term Crypto Success

Achieving long-term success in the crypto market requires more than just capital and research; it demands the right mindset. Patience is perhaps the most critical virtue. The market moves in cycles, and periods of downturn are inevitable. Investors who panic sell during a bear market often miss out on the subsequent recovery and bull run. A long-term perspective helps in staying committed to a well-researched strategy. Understanding Crypto 30x

Continuous learning is another essential component. The crypto space evolves at a breakneck pace, with new projects, technologies, and regulations emerging constantly. Staying informed is not a one-time task but an ongoing process. Engaging with educational resources, attending webinars, and participating in community discussions are all ways to keep knowledge current and relevant.

A path leading into the distance, symbolizing a long-term investment journey.

Finally, emotional discipline separates successful investors from the rest. The fear of missing out (FOMO) can lead to impulsive buys at market peaks, while fear, uncertainty, and doubt (FUD) can trigger sells at the bottom. Developing the discipline to stick to a plan, ignore market noise, and make decisions based on logic rather than emotion is the ultimate key to navigating the crypto landscape successfully. This mindset, combined with thorough research, forms the foundation of a sustainable investment approach.

Exploring the Future Trajectory of Cryptocurrency Innovations

The future of cryptocurrency is brimming with potential, driven by continuous innovation. Key areas like decentralized finance (DeFi), non-fungible tokens (NFTs), and Layer-2 scaling solutions are pushing the boundaries of what’s possible. DeFi aims to recreate traditional financial systems—lending, borrowing, insurance—in a decentralized, permissionless manner, opening up access to financial services for millions globally. Bitcoin Whitepaper

NFTs have evolved beyond digital art, finding applications in gaming, real estate, and intellectual property management. They provide a way to tokenize and prove ownership of unique assets on the blockchain. Meanwhile, Layer-2 solutions are addressing the blockchain trilemma of achieving scalability, security, and decentralization simultaneously. Technologies like rollups and sidechains are making transactions faster and cheaper, which is crucial for mass adoption.

The intersection of AI and blockchain is another frontier being explored. This convergence could lead to more efficient smart contracts, enhanced security protocols, and novel data marketplaces. As these technologies mature, they will create new investment opportunities and potentially new asset classes. The platforms and communities that can identify these trends early will be at the forefront of the next wave of growth.

Frequently Asked Questions

What does “crypto 30x” mean?

“Crypto 30x” refers to cryptocurrencies that have the potential to increase in value by thirty times their initial investment. These opportunities are often found in emerging sectors or innovative projects with strong fundamentals.

How can I find crypto 30x opportunities?

To find crypto 30x opportunities, conduct thorough fundamental and technical analysis. Focus on projects with innovative technology, strong teams, and clear use cases. Stay informed about market trends and emerging sectors.

What risks are involved in chasing crypto 30x returns?

Chasing crypto 30x returns involves high risks, including market volatility, project failure, and regulatory changes. Diversify your portfolio, set realistic expectations, and use risk management strategies to mitigate these risks.

Is it too late to invest in crypto 30x opportunities?

The cryptocurrency market is still young, with new opportunities arising regularly. While some sectors may be saturated, emerging trends and innovations continue to create potential for high returns. Stay vigilant and informed to capitalize on these opportunities.

How important is community support for crypto 30x projects?

Community support is crucial for the success of crypto 30x projects. A strong community drives adoption, provides feedback, and contributes to the project’s ecosystem. Projects with active and engaged communities are more likely to achieve long-term growth.

Kim Taehyung: The Multifaceted Maestro Redefining South Korean Artistry